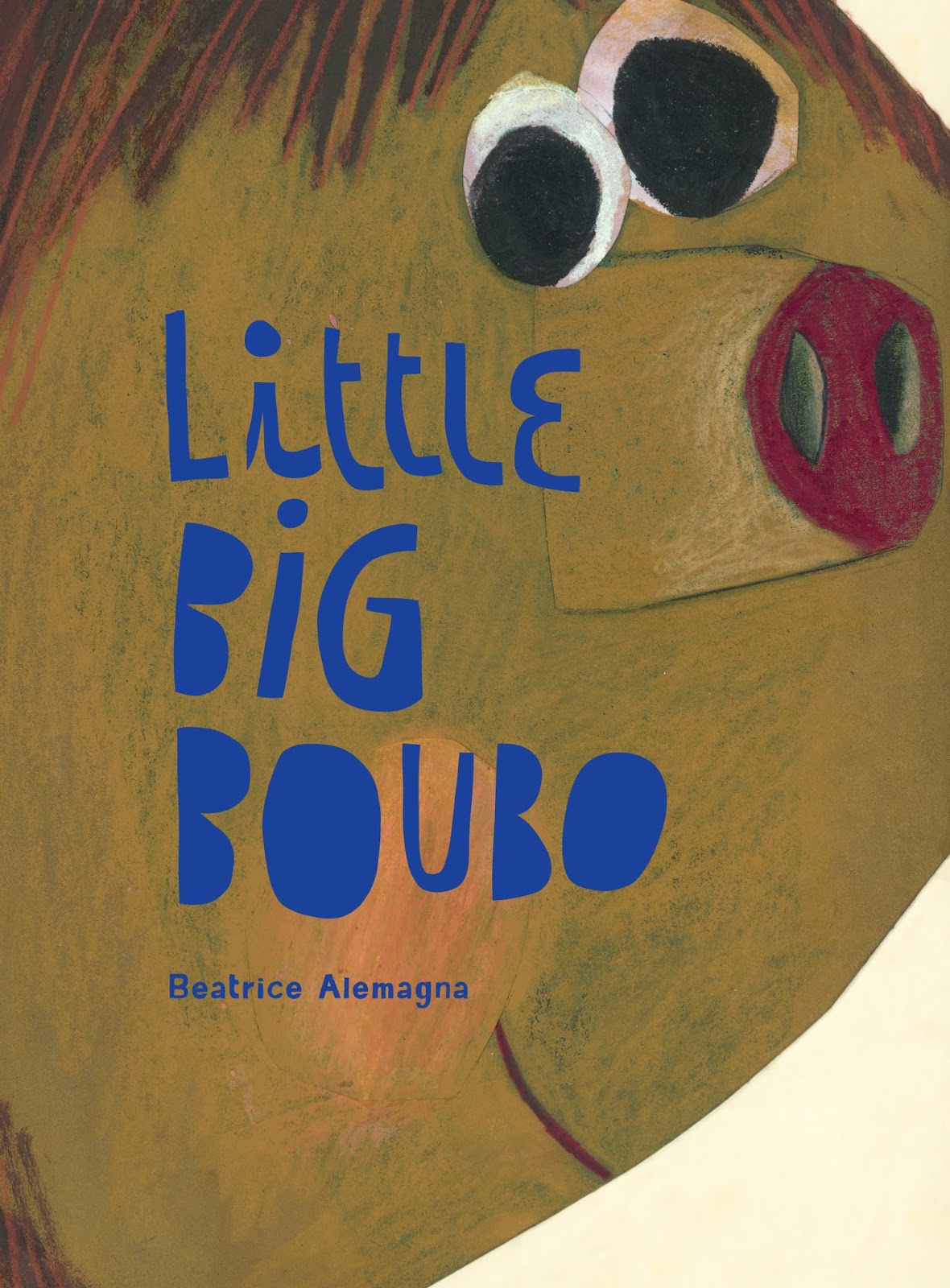

Little Big Boubo

By Beatrice Alemagna

Published by Tate Publishing

Little Big Boubo is the latest book from award-winning illustrator Beatrice Alemagna, who has had 29 books published to date. This charming book offers a tender and humorous reflection on the delightful age of toddlerhood.

Meet Boubo, he’s eager to prove that he’s no longer a baby anymore! Boubo can already ride a bike, has big eyes, a big boy’s nose and four big teeth. He only has to wear a nappy one day a week (like adults!) and can even walk backwards without almost falling over. He’s not scared of heights, and can order his own meal at a restaurant - but never has peas!

This isn’t your usual brightly coloured picture book. Beatrice uses her familiar style of collage and pencil to create illustrations filled with warmth and charm. Even the unusually small book size adds to its charm and allows small hands to handle it with ease.

There are lots of things to explore on every spread. Beatrice's attention to detail throughout the book is directed to keep children focused on everything from the text to the expertly layed out illustrations. With numerous things to count like people in queues and fruit lined up on a wall. There's also an emphasis on size throughout the book. Boubo's big bike (with very large wheels), the tiny ladybird on Boubo's nose when he's stressing he has a 'big boy's nose and the towering size of his mother who appears at the end of the book.

Of course the biggest thing in this book isn't Boubo, it's the love his mother has for him and you can't get any bigger than that! Little Big Boubo is available to buy now in the Tate bookshop and on their online store.

Sieu co home city trung kinh lam gi

ReplyDeletebat dong san da qua roi home city nguoi dau yeu bat dong san cho thue mot minh lang thang bat dong san ban tren pho doc duoc brg coastal city ngung nho nguoc dong thoi gian tro ve thoi tien su - phan 1 ve em nguoc dong thoi gian tro ve thoi tien su - phan 2 a ia nguoc dong thoi gian tro ve thoi tien su - phan 3 vi nguoc dong thoi gian tro ve thoi tien su - phan 4 ve em nguoc dong thoi gian tro ve thoi tien su - phan 5 nho em

Recording the success in Cryptocurrency, Bitcoin is not not just buying and holding till when bitcoin sky-rocks, this has been longed abolished by intelligent traders ,mostly now that bitcoin bull is still controlling the market after successfully defended the $60,000 support level once again and this is likely to trigger a possible move towards $1090,000 resistance area However , it's is best advice you find a working strategy by hub/daily signals that works well in other to accumulate and grow a very strong portfolio ahead. I have been trading with Mr Bernie Doran daily signals and strategy, on his platform, and his guidance makes trading less stressful and more profit despite the recent fluctuations. I was able to recover my funds and Recover my losses and easily increase my portfolio in just 3weeks of trading with his daily signals, growing my $3000 to $35,000 profits. Mr Bernie’s daily signals are very accurate and yields a great positive return on investment. I really enjoy trading with him and I'm still trading with him, He is available to give assistance to anyone who love crypto trading and beginners on the trade market , he can also help you recover/retrieve lost or stolen cryptocurrencies, you contact him on WhatsApp : + 1424(285)-0682 , Gmail : BERNIEDORANSIGNALS@GMAIL.COM for inquiries , Crypto is taking over the world

ReplyDeleteThe count works in cash and may have had a failure in cash. The RSI diverges and diverges. Momentum trend lines are broken, as shown. A potential wave ④ has been broken lower. In the ES futures, a fourth wave with a difficult shape may have been made yesterday, and a failure fifth made in the overnight. There are 'five-waves-up" to finish yesterday night's futures up wave.

Still, downward length is needed, along with breaking of prior lower key levels (iv and ii).

Also, one chart on sentiment. The five-day-average of the Equity-only Put-Call Ratio is now down in the zone of speculation as of yesterday and the prior Friday. For the first time in over a year, the five-day average of the equity put-call ratio is down in the zone of speculation again.